According to the Office for National Statistics (ONS), UK’s Consumer Prices Index (CPI) rose by 5.1 percent in November 2021, the highest peak in 10 years. The UK interest rate is held at 0.25 percent, which is undoubtedly bringing economic pressure to many people.

In October, UK inflation was already as high as 4.2 percent. Bank of England (BoE) forecast CPI to rise to five percent in April 2022, but the fact is that this arrived five months earlier than the predicted date.

Inflation is the rate at which prices rise over time. For example, If the cost of a £1 box of strawberries has increased by 10p, then the inflation rate for strawberries is 10 percent.

An interest rate rise may reduce the inflation rate, but it can cause an increase in the cost of living, as people need to pay more money for their loans and mortgages, although it will benefit people with savings.

People’s incomes should keep up with inflation so that they are not squeezed due to the increase in the cost of living.

Suren Thiru, Head of Economics at the British Chambers of Commerce (BCC), commented on November’s inflation statistics and said: “It is concerning that inflation is outpacing wages and if this disparity continues to increase as we predict, real household incomes will be squeezed further, dampening consumer spending, and weakening overall economic activity.”

Inflation is closely linked to transportation prices, while fuel costs have surged significantly in recent months.

According to the ONS report, petrol prices between October and November this year broke a 20-year record. In November, the average price of petrol was 145.8 pence per litre, the price of a litre of petrol rising by 7.2 pence.

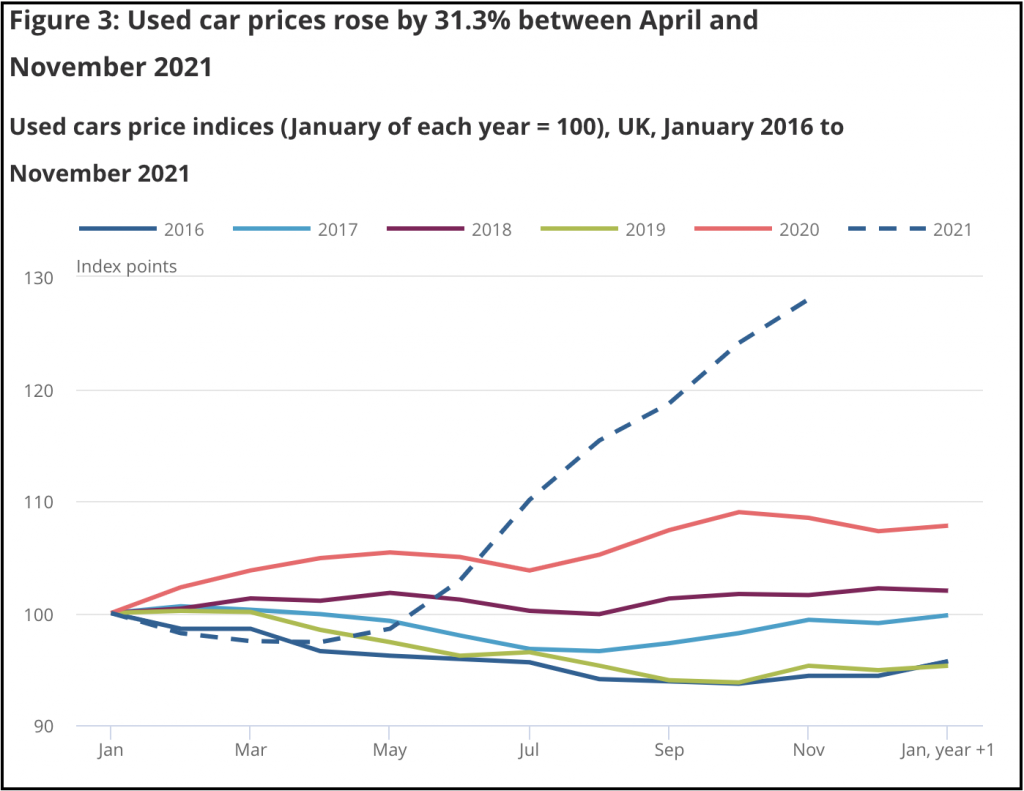

The price of used cars rose by 31.3 percent from April to November this year. One of the main reasons was because people began to seek alternatives to public transport to avoid close contact with other people.

Global shortage in semiconductors, an essential material to produce new cars, is another reason for the rise of used car prices and affects people’s living costs.

A surge in the Omicron variant cases in the UK will also influence future inflation. Thiru said: “Omicron could accelerate the current surge in inflation if restrictions in the UK and overseas to combat the new variant trigger more supply chain disruption.”

One member of the BoE Committee thinks that the significant uncertainty introduced by the Omicron variant warranted waiting until February for more clarity before considering any change in Bank Rate.

Words: Zhen Guo | Subbing: Saray Ramiro Fernandez

Be the first to comment on "UK inflation rose to 5.1%, Bank of England raises interest rates to 0.25%"