The research from the Fiscal Studies found that most graduates did not succeed in repaying their student debt in full.

Student debts are a consequence of student loans, in fact, students that cannot afford the cost of university are forced to ask for help from the government. Each year as stated by the House of Commons Library, more than £16 billion is loaned to approximately one million students every year in England.

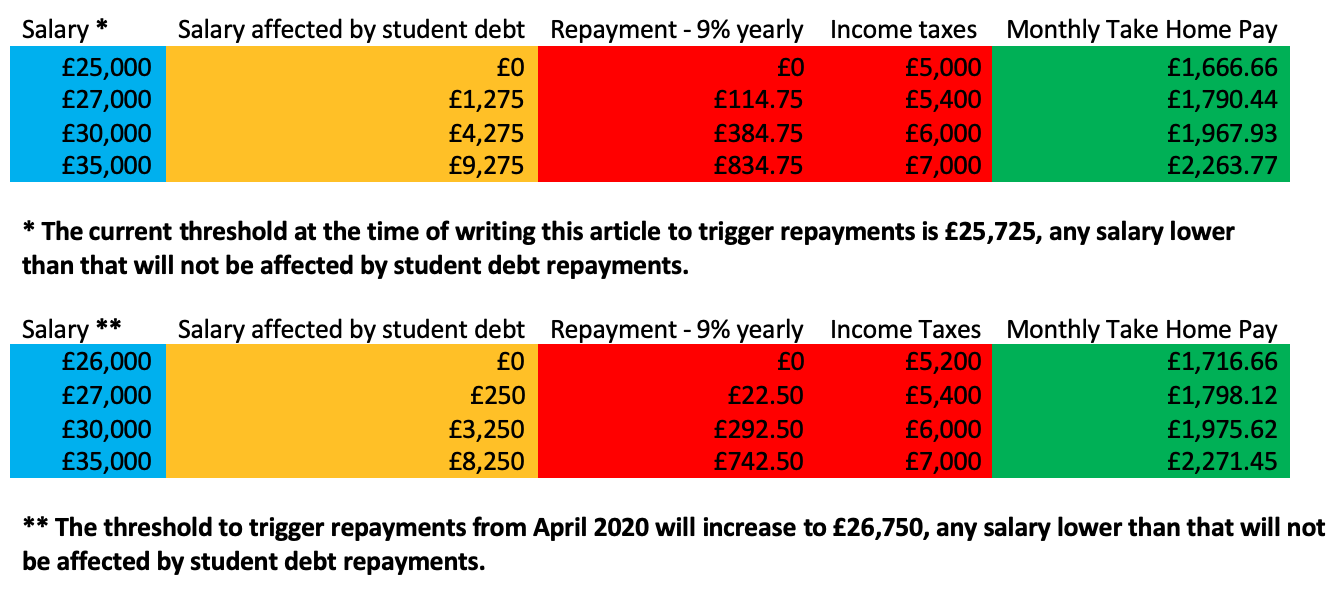

The repayments only start when the graduate is earning above £25,725 per year, and from April 2020 the threshold level is rising to £26,750. Graduates will be required to repay 9% on the difference between the threshold amount and their current salary, however, after 30 years the student debt is automatically written off.

Although the government expects the 30% of graduates that are working full-time and have benefited from the loan will repay it in full, the value of outstanding loans at the end of March 2019 reached £121 billion.

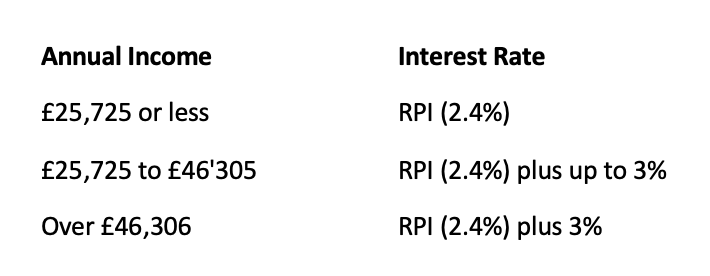

In addition to the 9% there is an interest rate that is built up with the loan, which is added from the date of your first payment while you are studying. The interest rate depends on how much the graduates are earning.

The interest rate is calculated using the Retail Price Index (RPI), which is currently set at 2.4% plus 3%, resulting in a 5.4% interest rate.

Table1 by Giulia Frau, information taken by Gov.uk

Interview with the expert

Voice of London contacted the host of The Meaningful Money Podcast, Pete Matthew. He recently completed a series of podcasts about Millennial Finance where he explained in depth what millennials need to learn in order to become financially literate.

We collected a series of questions that students or graduates across Westminster University were interested to learn about student debt.

Taking into account that London is very expensive, do you think a graduate can “survive” on a 25k salary? If yes, what advice could you give to keep their finances in order to help cope with London’s high living expenses.

“London is expensive, for sure. It can be hard to live on a low salary – I get it. But the only people who can complain about that are those who have aggressively reduced their costs to a minimum. Only then, having done everything you can, are you allowed to complain about external factors. You don’t have to live on Pret, you can eat much more cheaply if you take in lunch. Limit unnecessary expenditure and I imagine you could get by, but I know it wouldn’t be easy.”

Can you briefly explain how a student loan affects a mortgage application? i.e. focus is on take home pay rather than the loan amount.

“Mortgage applications look at both multiples of salary and affordability to determine how much a lender will lend to you. If you’re paying student loans back, your take-home pay will be lower, and hence will affect the affordability factor, reducing the amount you’re likely to be able to borrow.”

Would you recommend overpaying the debt each month, or keeping to the 9%? Could you briefly detail your argument for & against each option?

“I’d never overpay student debt. It just isn’t a debt in the true sense of the word. I’d invest any extra I had over and above the payments because you’ll likely make more than the interest you save by overpaying. BUT, if having the debt is a psychological burden, then overpay by all means. Debt repayment vs investing is always more a brain-issue than maths. The maths will always stack up in favour of investing, unless you’re paying very high interest on the debt.”

Regards the re-payments plans, how does it work for Freelancers/Self-employed?

“It’s worked out through your tax return, so repayments are effectively added to your tax bill each half-year.”

What means of investing could you recommend for a student looking to make better use of any savings?

“Most students can’t save regularly because they don’t have a big enough income while they’re studying. If you do have any excess that you don’t think you’re going to use, then I’d look to invest in a Lifetime ISA if you think you might want to buy a house one day. Or just an ordinary stocks and shares ISA if you think you might need access to the money. Pick an aggressive investment fund (low-cost tracker ideally) and forget about it. But always keep sufficient cash in the bank for your foreseeable needs.”

Can you briefly explain how a student loan is more like a tax rather than traditional debt?

“Because it is paid back as a percentage of salary (9%) over a threshold (will be £26,750 from April) – just like income tax is worked out – rather than repayments being based on what you owe and the term.”

What is your overall opinion on the current system as it stands?

“I’d prefer tuition to be free to students like it was when I went to Uni, except it never was free, not really. When people got grants instead of loans, the grants were still paid-for by the state, and so we paid in higher taxation. This way it’s more transparent in my view, and those who borrow it take the higher share of the burden of paying it back, which seems fair to me. So, in summary, I think it’s a pretty fair and decent system.”

What is the final piece of advice you’d like to offer students leaving university with £50,000 or similar of student debt?

“Don’t sweat about the number because it’s meaningless. What matters is your repayments. To put that in perspective, a graduate earning £35,000 per year(!) will only be paying £62pm back, which is about 2% of their salary, really not the end of the world. If you earn more, you’ll pay more. Don’t cry about it – that’s life. Best advice is to MASTER your daily budgeting skills. Don’t buy stuff you don’t need until you can afford to do so. Concentrate on the daily small decisions about what you spend. Start saving early, even if the amounts are small. Automate them to go out of your account on pay day and make this a habit for life. Also commit to increasing the savings every few months.”

Table2 by Giulia Frau

Podcast

Useful Links

Words: by Giulia Frau | Infographic tables: By Giulia Frau, information collected by gov.uk (table 1)| Interview: by Giulia Frau | Podcast: by Giulia Frau | Image: Pexels.com